Pharmacy Solution

Lumere (f.k.a. Procured Health)

Research, UX, UI, Testing, QA

February - October 2017

Web

Brief

Design a new tool that optimizes complex Pharmacy department spend and utilization within scattered hospital systems.

Context and problem

Formulary evaluation is a tedious process, sometimes taking six months to just reach a decision on which drugs to remove from or add to the pharmacy. Healthcare leaders have to consider cost-savings, efficacy, and variation of which pharmaceuticals are preferred by the doctors at their various hospitals.

This process is slowed down and further complicated by purchasing and utilization data living in different tools, usage data being received in disparate formats, and infinite trial information and literature to sift through to become acquainted with a trustworthy option.

When asked which area in their organization has the most potential savings, 67% of supply chain staff responded that their pharmacies were rife with savings opportunities.

How might we bring together vital and accurate information to guide decision makers for optimal savings and patient outcomes?

Highlight Savings Opportunities

‣ Where am I spending too much?

‣ Where has my spend grown over the fiscal year?

‣ Where is there a lot of variation in utilization within my organization?

Aggregate Various Data Into Comprehensive Data Visuals

‣ What story does my purchasing data tell me when I match it with utilization data?

‣ How much drug cost disparity exists in my organization after units are normalized across clinically equivalent products?

Serve Relevant Evidence with Analysis

‣ How do I begin sifting through the mountain of research and reports on clinical trials?

‣ How do I determine which drugs are comparable and make the right clinical recommendation to enact?

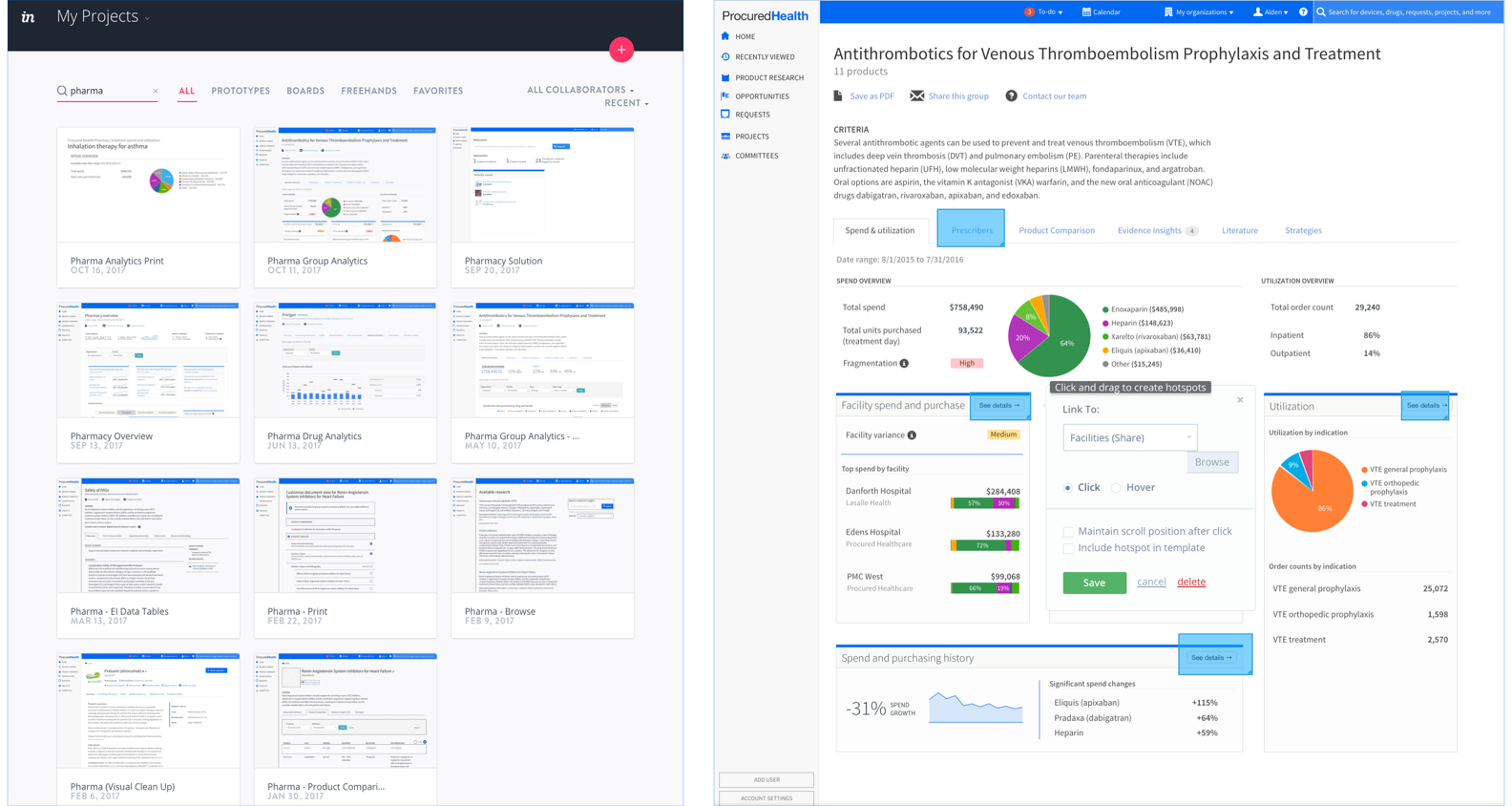

Process

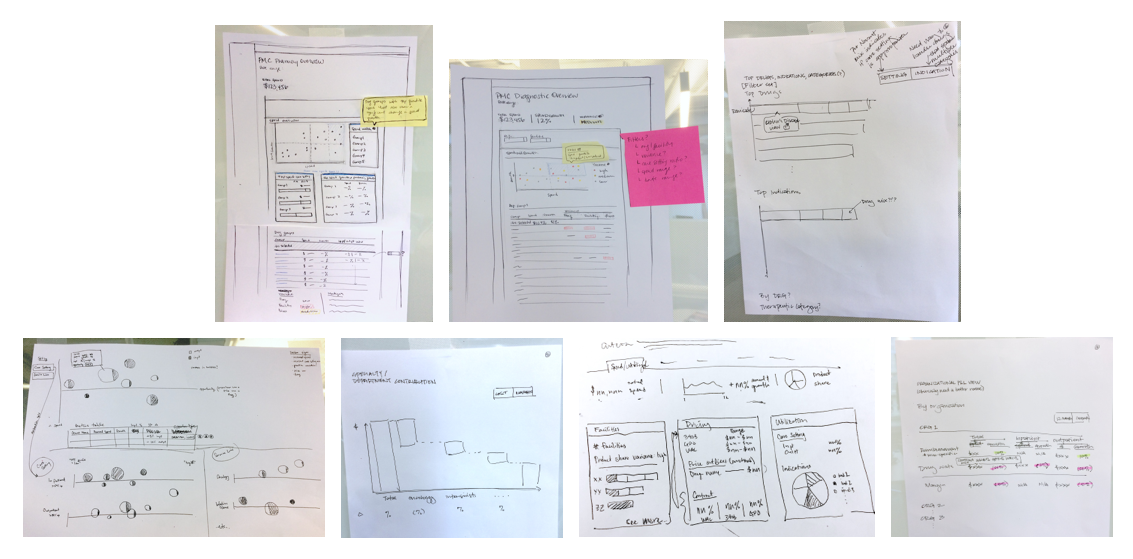

The Pharmacy Solution started off as a new product idea living in a series of Powerpoint slides being shopped around with Procured Health's network of pharmacy professionals. The business owner and PM had been working with their research team to put together presentations of clinical recommendations based on real hospital data.

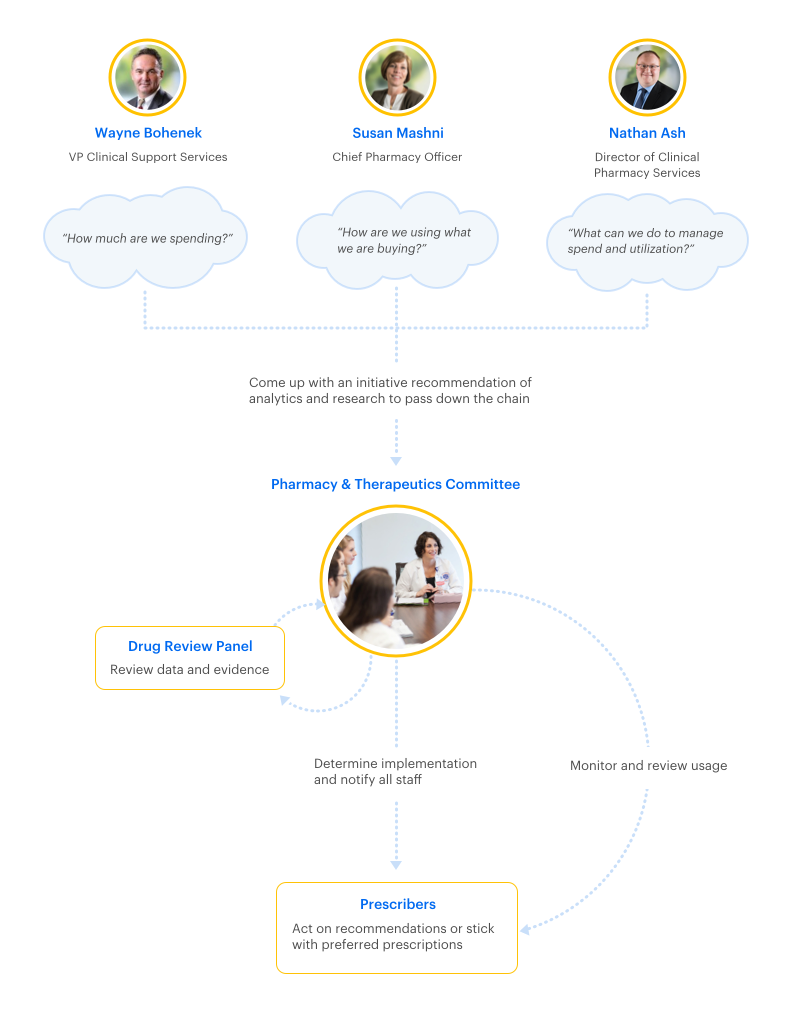

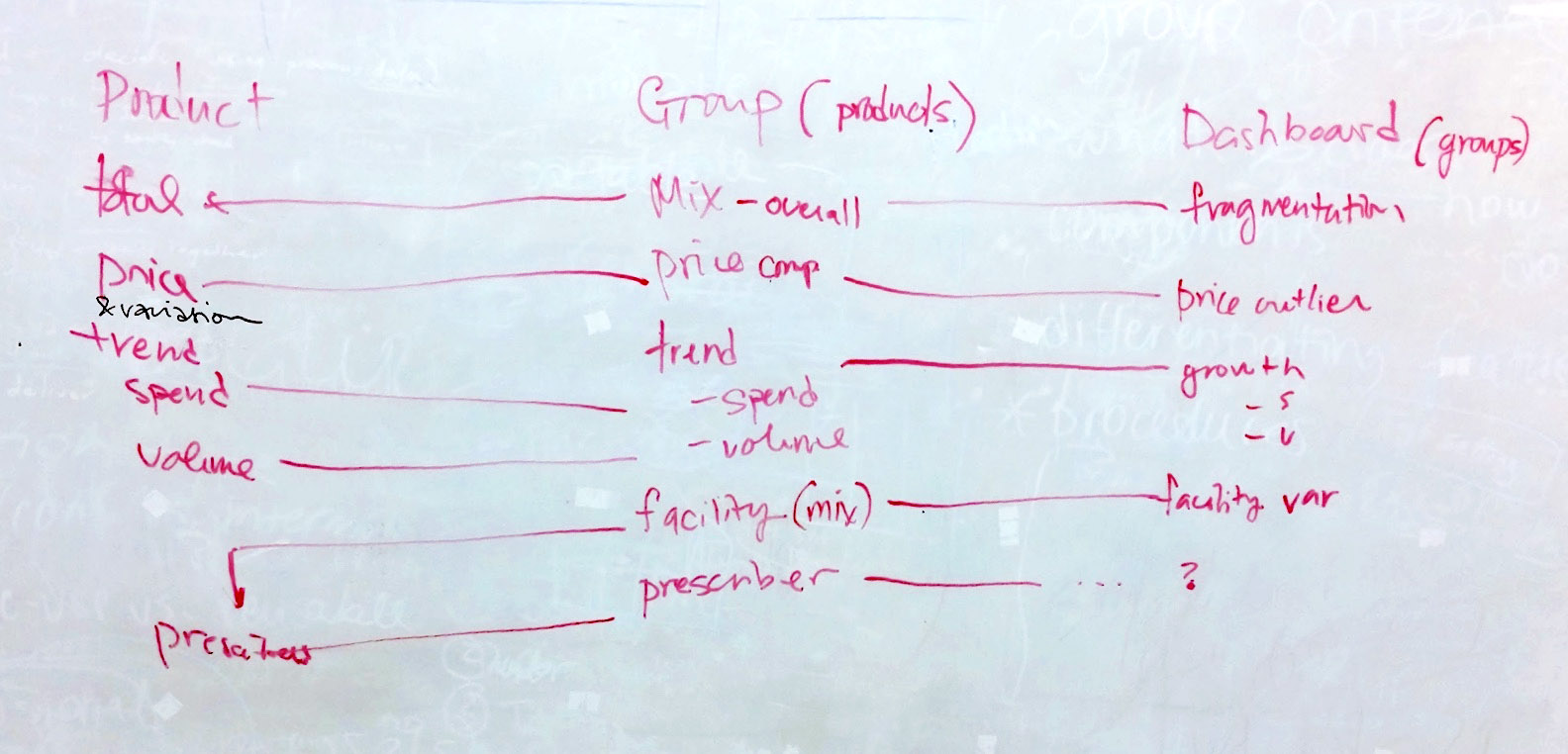

Taking a Step Back

To make sure we are answering all the above questions for stakeholders, we completed a Jobs to be Done exercise for all the levels of users across a hospital system.

Are we providing actionable data at each level of need?

After a workshop of brainstorming and discussing priorities, we came out with an idea of how to organize groupings of data and how to answer important utilization, spend, and clinical questions at all levels of the organization.

Bringing All the Information Together

It's Live!

On October 3rd, 2017, Procured Health launched the Pharmacy Solution. There were 5 pilots signed up to have their real data in the system and full access to our entire library of research, compiled by the Procured Health Research Team.

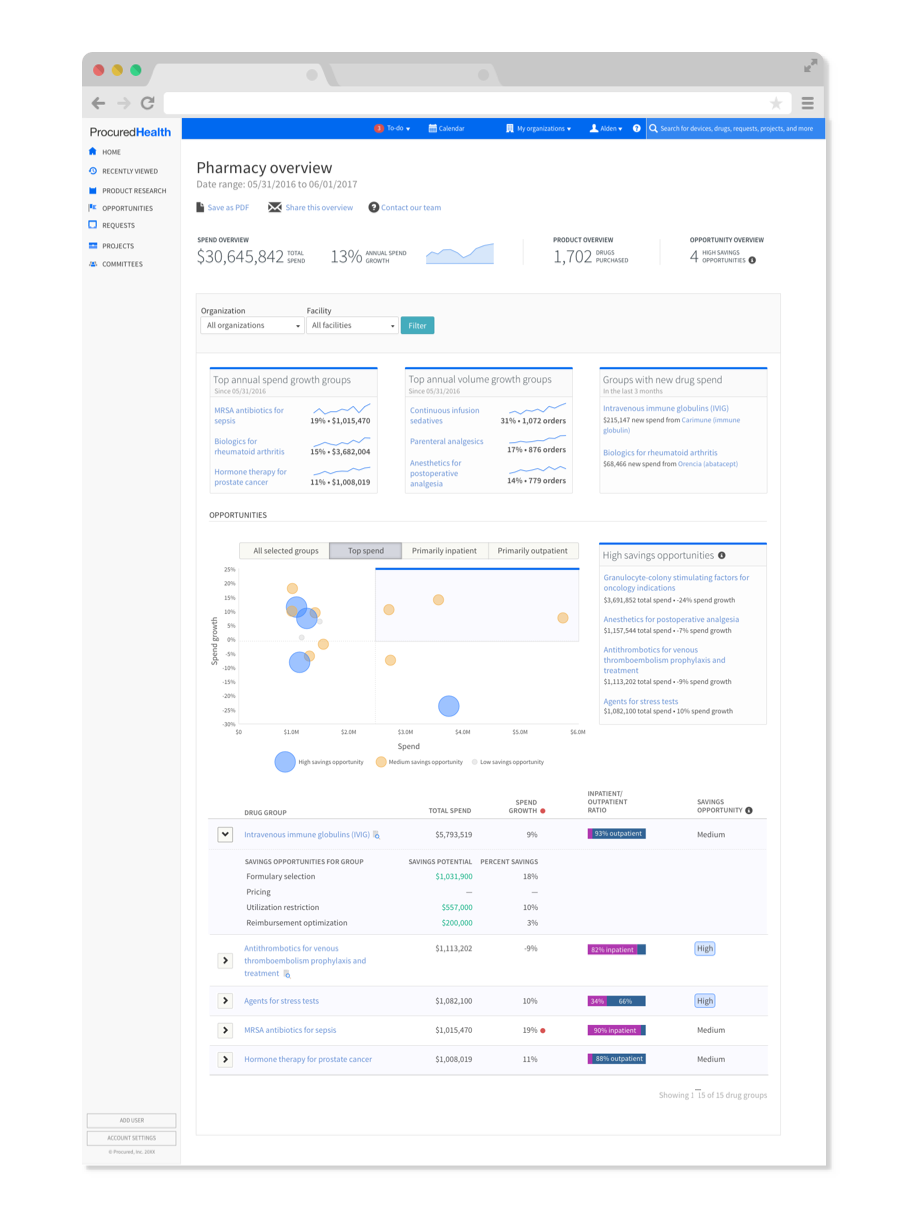

Pharmacy Overview

This acts as a bird's eye view of activity in the organization's pharmacy. Healthcare leaders are provided with cues to identify and prioritize savings initiatives.

The Pharmacy Leadership Team can identify:

‣ Total pharmacy spend and highest spend drug groups

‣ Possible unexpected growth in spend

‣ Groups with high savings potential based on notable variation in pricing/practice

‣ Causes for spikes in overall spend

From there, Clinical Pharmacy Services Directors like Nathan Ash can drill down into a drug group of interest.

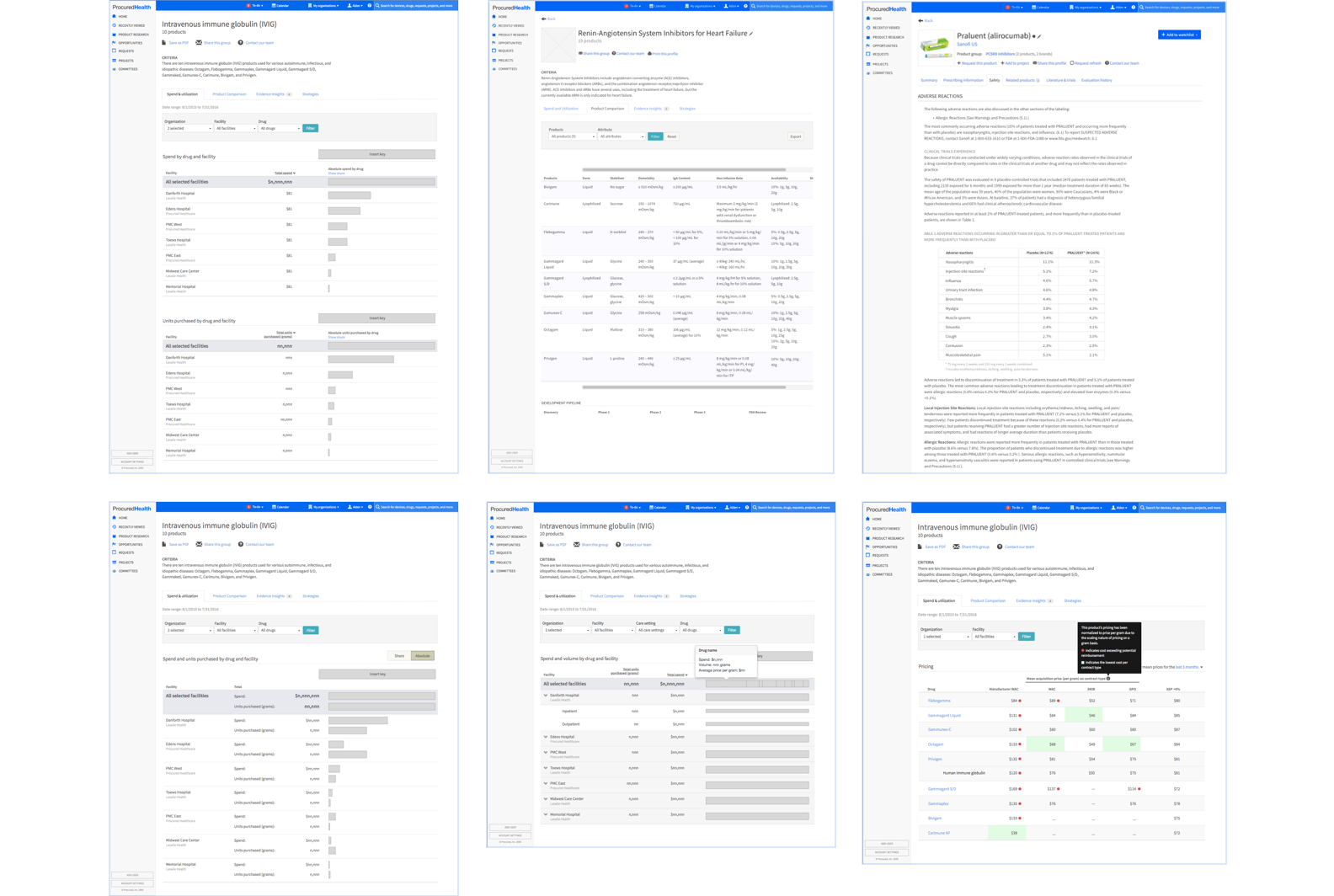

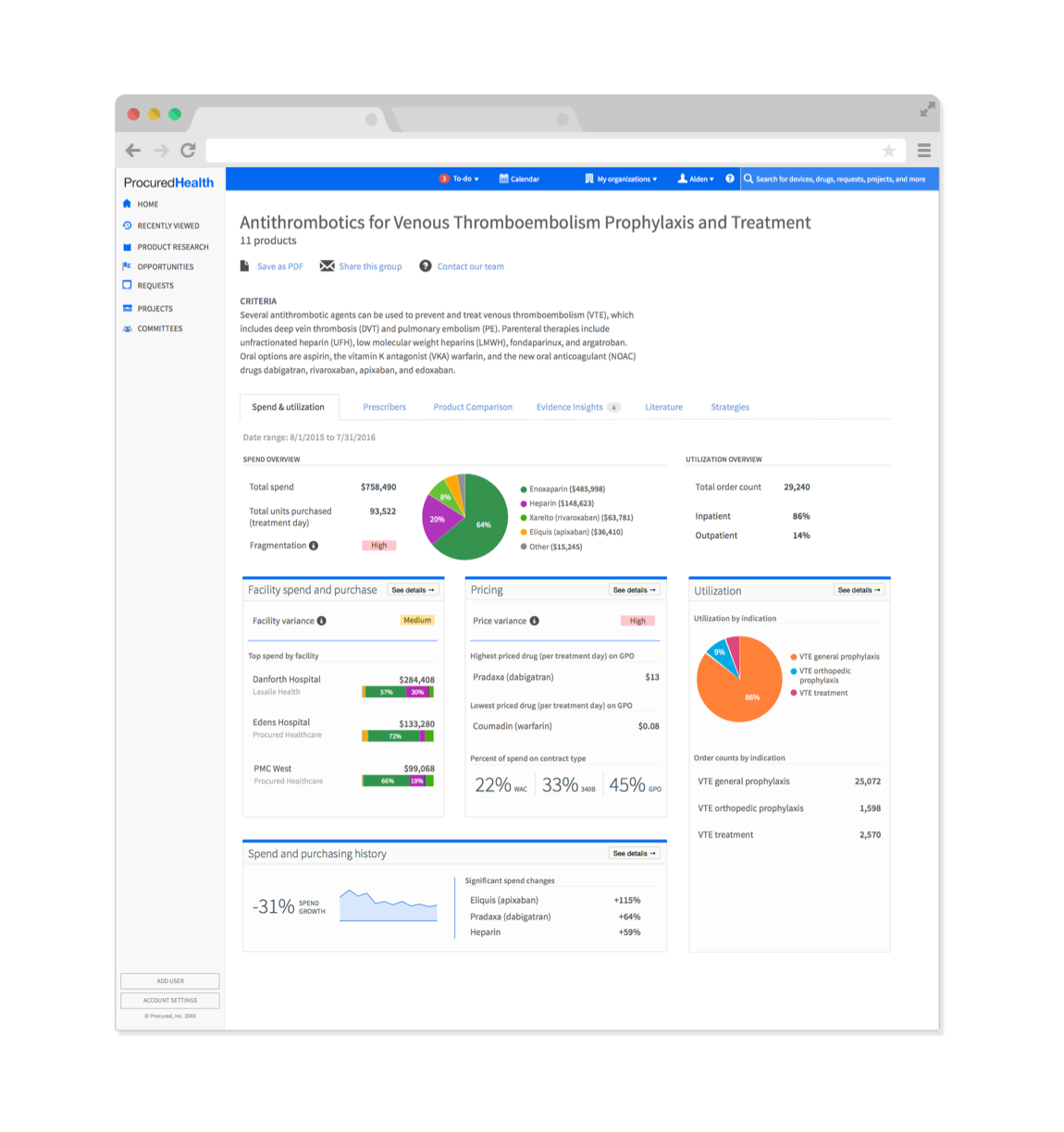

Group Spend and Utilization Overview

Once a group of clinically equivalent drugs has been identified as requiring further investigation, pharmacy directors can gain a grasp of where variation or opportunities for intervention are within the group at this level.

Pharmacy directors can see:

‣ The spread and variation of drugs purchased within this group

‣ Which facilities are the biggest spenders

‣ Price variation and if purchases are made on the expected ratio of contract types

‣ How much spend is moving in the group, and which drugs are exhibiting the biggest shifts in purchasing behavior

‣ If drugs are being prescribed for inappropriate indications

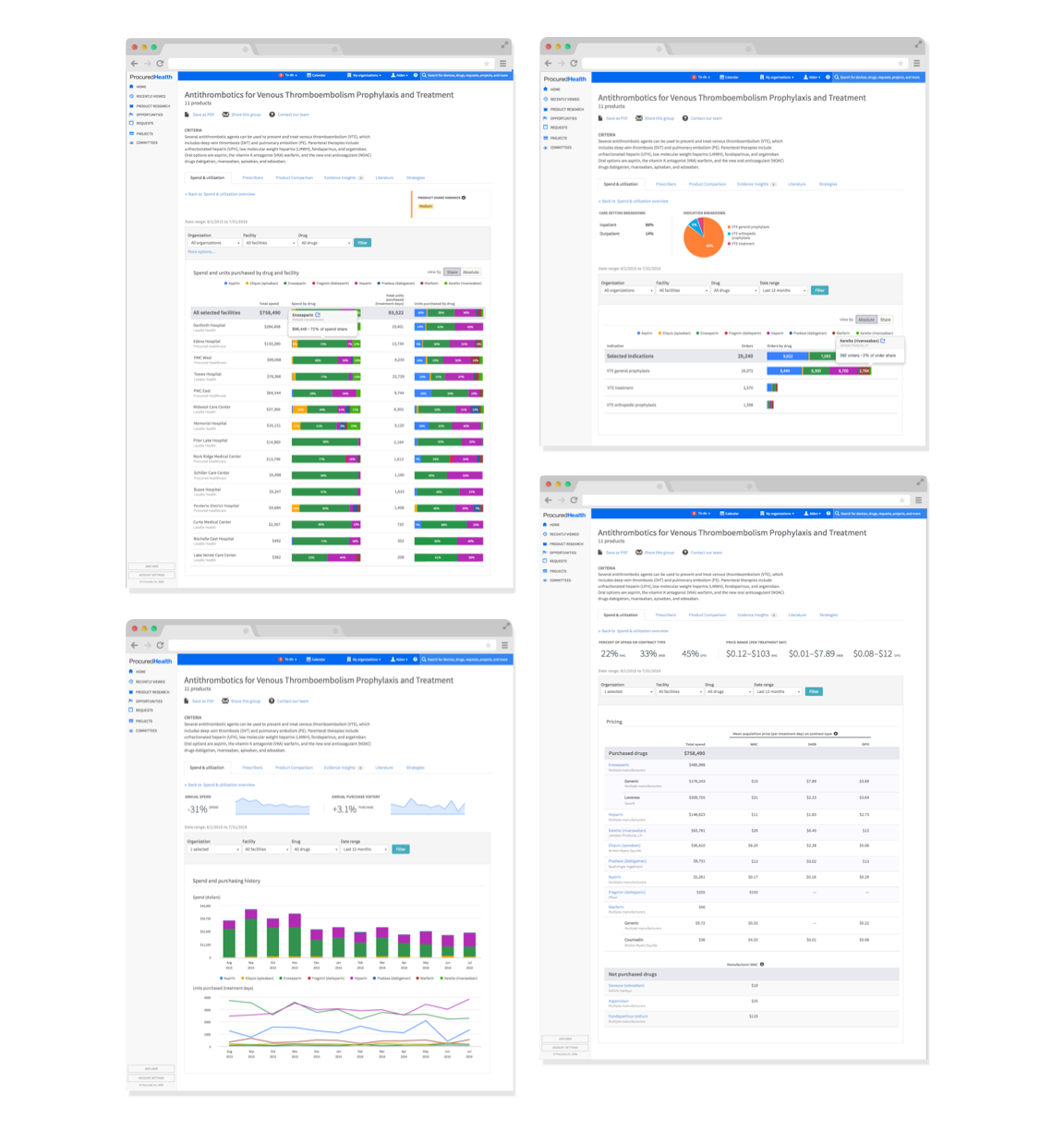

Digging into Group Data

Pharmacy directors can click any of the cards above to deepen their understanding of spend, utilization, trends in purchasing, and the range of pricing between clinically equivalent drugs.

Data is laid out to detail:

‣ Which facilities are purchasing what volume of drugs, and how their purchasing breakdown compares across the organization

‣ The most expensive drugs being purchased, and which clinically equivalent and more cost-effective drug can take its place in the formulary

‣ Which indications are being logged in electronic health records and if drugs are being utilized inappropriately

‣ Which drugs are contributing to significant or unusual shifts in spend

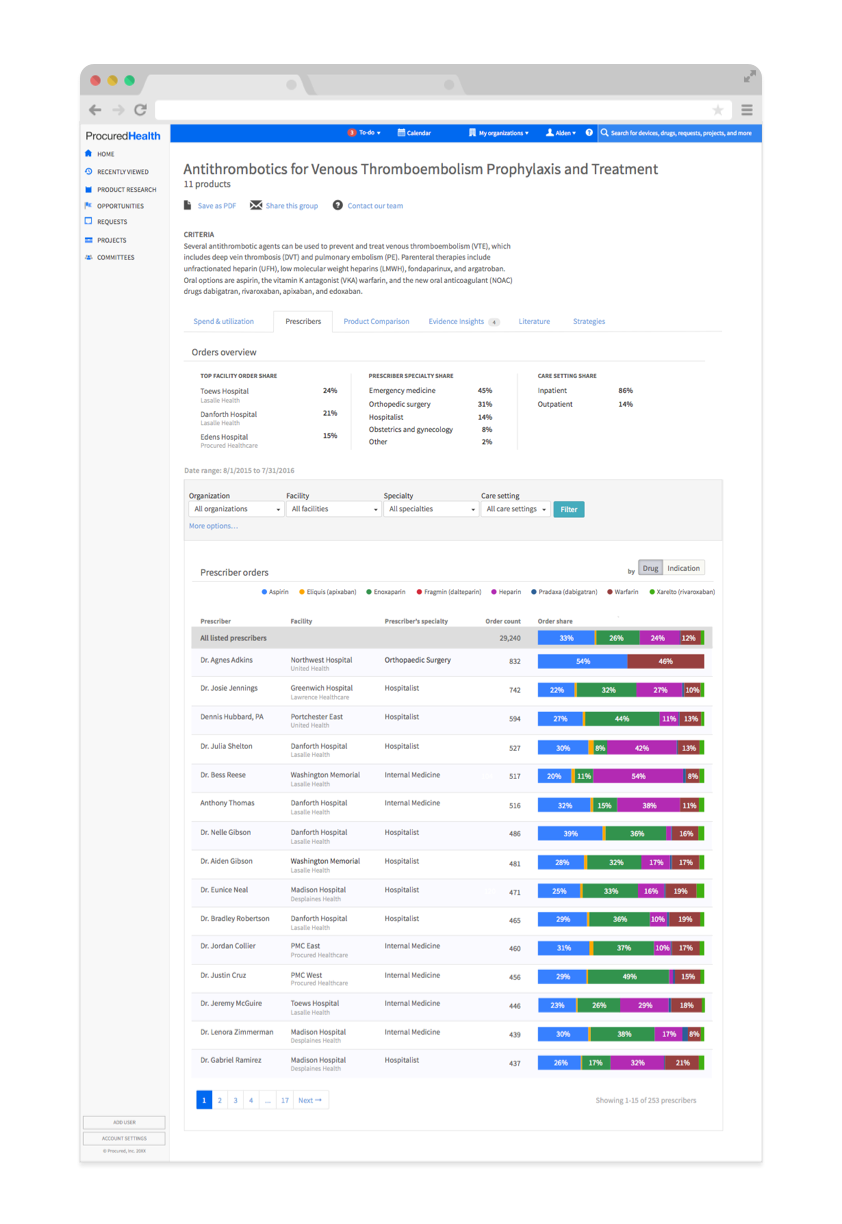

Addressing Prescriber Behavior

After a decision has been reached on what changes are being made to the formulary, staff members have to be notified. Pharmacy directors are able to see who is a power prescriber (and needs to be treated with kids gloves), or who is not being compliant with recommendations.

Pharmacy directors can see:

‣ Which prescriber is prescribing too many redundant drugs

‣ Which prescriber is going against formulary changes

‣ How prescriber behavior compares across the organization or even a facility

‣ Which prescribers will need to be followed up with to address their order behavior

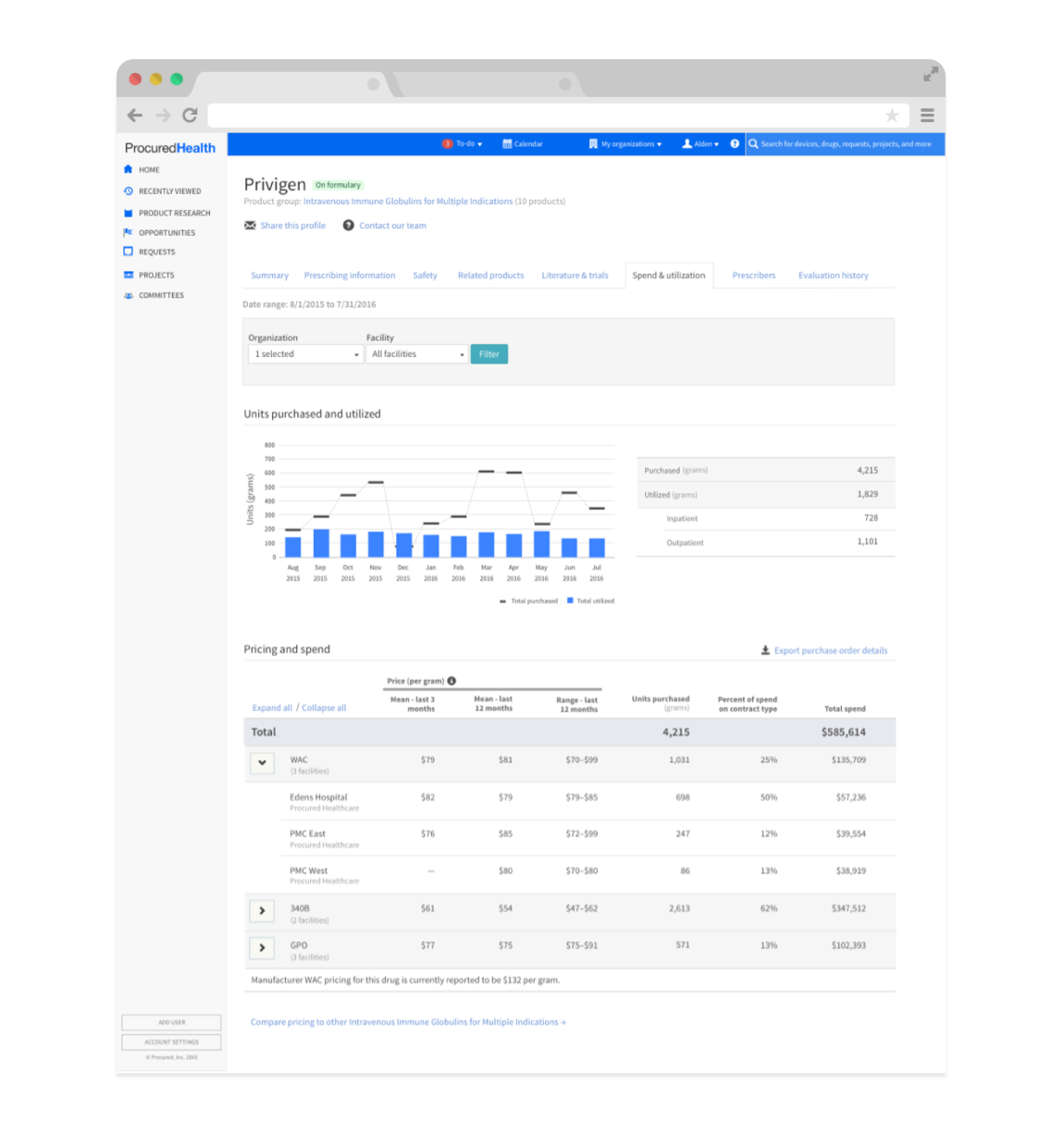

Decision Making at the Drug Level

Pharmacy directors can make informed and tactical decisions about purchasing changes with the most drilled down data. At the drug level, they can gain the a full scope of usage trends, mix of prices, and spend of a specific drug.

Decisions are informed by:

‣ Clear comparisons of volume of of drug purchased against how much was actually prescribed

‣ The range of prices paid for the drug with different contract mixes

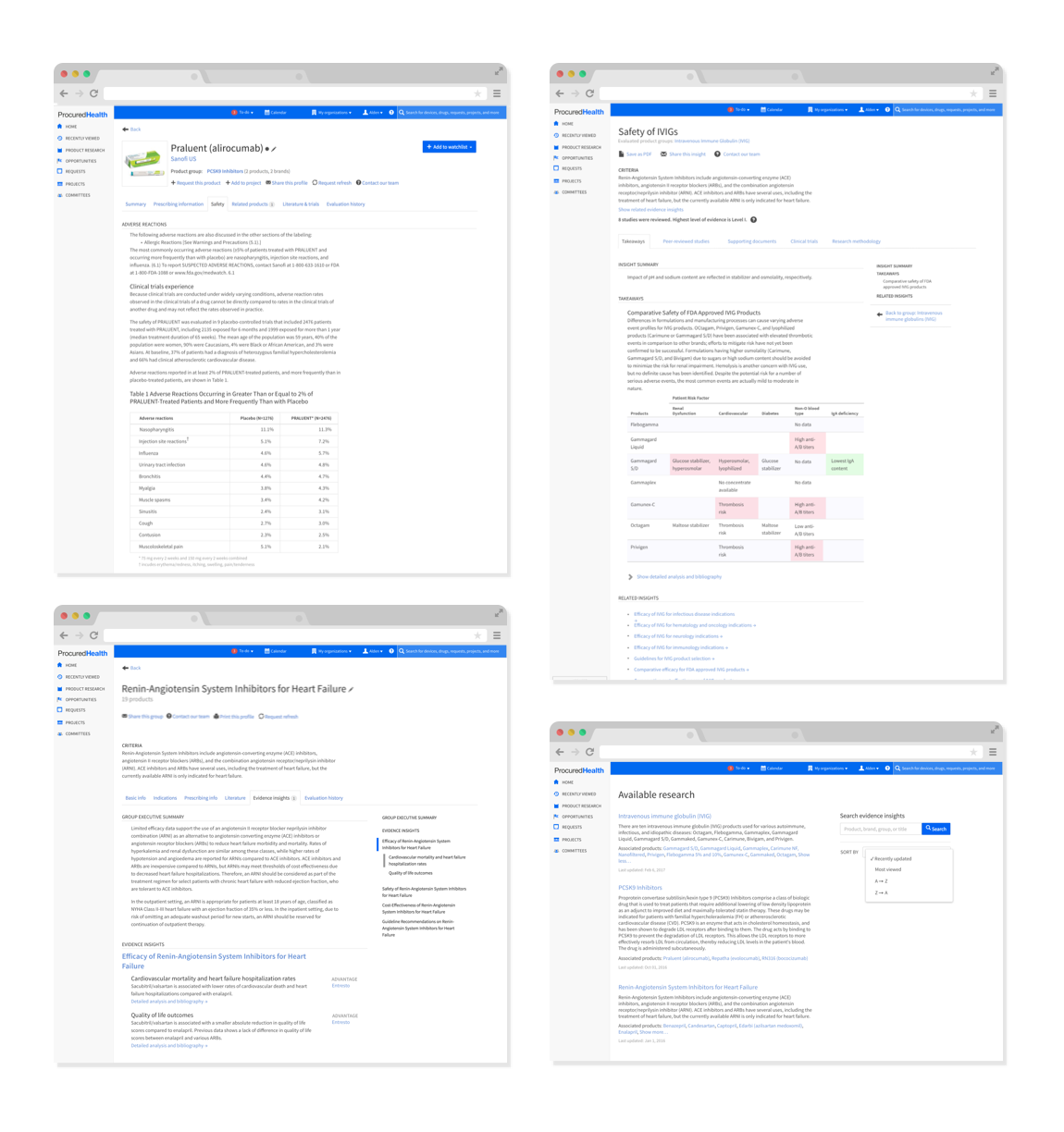

Supporting Decisions with Evidence

To help bolster formulary decisions, in-house compiled research is available at the drug group and individual drug levels.

The Pharmacy and Therapeutics Committee can easily review:

‣ Which drug in a group has advantages in efficacy, cost-effectiveness, guidelines, and safety

‣ Relevant literature and results from clinical trials

‣ Levels of evidence (trustworthiness) of all evaluated documents, as well as if they are biased by sponsorships

‣ Side-by-side comparison of drug attributes, including care, adminsitration information, and dose strengths

Reviews from the Field

We heard enthusiastic feedback from some of our pilot users, as well as potential new clients. New users explained that they previously have had a hard time connecting financials and utilization. It has become much easier to understand what is happening across their multiple facilities and the bottom line impact.

"This is going to save us so much time and make it more efficient to manage the pharmacy. We have a lot of trouble getting data from our EMR and and things you want to accomplish lose steam because it usually takes so long."

Tyler L. (Pharmacy Residency Program Director) at St. Charles

"I get asked for this information frequently by leadership; it was very labor intensive to get and not 100% accurate. I had to mine this data and make interpretations myself... this platform is intelligent with the right pieces built into it."

Deb C. (Inventory System Specialist) at St. Charles

"This is really nice! Having the spend, the provider-level info, research all in context together is great. You can dig up anything in here."

Brian H. (Pharmacy Residency Program Director) at Sky Lakes

"There are a lot of other tools that are just simply too clunky to use and I really appreciate how clean this is comparatively."

Tom Y. (Outpatient Pharmacy Manager) at Sinai Health System